Fragrance to Function: How Beauty's Most Sensory Category is Evolving

Fragrance is one of beauty’s fastest-growing categories. But growth today isn’t about just smelling good. From multi-functional formats to strategic spending, shopper expectations are changing.

Welcome to the first issue of Beauty Active. Beauty moves fast, and for brand and category leaders, keeping up means separating signal from noise. I plan to make Beauty Active your resource that cuts through the noise of buzzy product launches, glitzy campaigns, and cultural chatter to give you the context that actually matters.

This week I’m focused on fragrance. Social platforms like TikTok have cracked open the category, fueling discovery for Gen Z and Gen Alpha shoppers, especially. What’s emerging now is a new set of shopper expectations: that fragrances must be more functional, more versatile, and more cost-effective than ever before.

Fragrance Shoppers are Demanding More from their Scents

In 2025, Statista estimates that the US Fragrance market will grow to over $9 billion in revenue as the category continues to accelerate. TikTok remains the primary growth catalyst fueling discovery among Gen Z and Gen Alpha shoppers who are seeking new, more functional scents with benefits.

This shift towards “functional fragrances” is made clear in research from Mintel, which indicates that fragrance shoppers are increasingly looking for scents that offer additional enhancements like: mood-boosting benefits and personalization.

“Shoppers are looking for products that do more than just smell good.”

Tatiana Pile, BeautyMatter

Fragrance Goes Functional: Scents for Mood, Personalization, & Wellness

Major Mass and Premium Beauty players are already responding to the trend, launching their own fragrance lines claiming added functionality:

Mood-Boosting Scents: Emotion as a Feature

Charlotte Tilbury’s Collection of Emotions — Arguably one of the trend-setters in this space, Charlotte Tilbury unveiled the Collection of Emotions in May 2024 which included six premium, functional scents that claim to leverage “emotion-boosting molecules” to influence emotional response.

The range is pretty wide, with the tagline “Spray me for…” anything from love, seduction, happiness, energy, and empowerment.

Currently priced around $150 for a 3.4 fl oz. EDP, and officially launched on Amazon earlier this month.

Charlotte Tilbury’s Collection of Emotions, promotional banner, Amazon Storefront (link)

adidas Vibes — Launched the same year in June 2024 (and refreshed this past summer with five new body mists) adidas released six mood-boosting, multi-functional scents, geared towards Gen Z shoppers that are “designed to make you feel positive.”

These are lower-priced for the Mass channel compared to the premium offerings of Charlotte Tilbury, currently priced around $35 for a 3.4 fl oz. EDP, and $18 for a body mist.

Scent names like “Get Comfy,” “Happy Feels,” and “Energy Drive” evoke the feeling each scent has been formulated to give you, and encompass a variety of feelings that a shopper might want to enhance throughout the day: from winding up to winding down.

Both of these collections feature occasion-based scenting formats, with scent names that suggest how each one can be leveraged or layered. This format ties in neatly with the fragrance shopper’s growing desire for building “capsule wardrobes” of fragrance. Specifically: small, tightly curated collections of scents chosen for their versatility and relevance in a variety of scenarios.

With full line-ups in Mass and Premium Beauty specifying these particular occasions or emotions, brands are trying to coax shoppers into buying more than just one fragrance to ultimately capture more of that space on shoppers’ shelves.

Personalized Scents: Your Skin, But Better

Glossier You Fleur - Glossier’s You fragrance collection was originally launched in 2017, but recently added a new, floral scent to the lineup this past spring. The main selling point? It smells like you. Glossier You is a lineup of musk-based fragrances designed to interact with your natural skin chemistry, resulting in a scent that is uniquely yours.

Musk-based “personal” scents are nothing new: classics like Kiehl’s Original Musk have been around for decades, but there seems to be a burgeoning trend for more “natural” or “pheromone-like scents” that rely more heavily on musk vs sweeter notes.

Glossier’s introduction of Fleur is a modern take on “personalized” musk that adds floral notes for a sweeter touch. I view this launch as a middle-ground for modern fragrance shoppers who are interested in something sweet but not too sweet.

The positioning of this EDP is focused entirely on skin chemistry personalization, with the bottle itself featuring a real thumbprint impression pressed into the glass.

Wellness Scents: Fragrance = Therapy

Beyond just “mood-boosting,” ancillary wellness benefits like: promoting higher energy, reducing overall stress, and enhancing sleep are also popular enhancements that fragrance brands are gearing toward.

One popular “holistic wellbeing” brand, NEOM Wellbeing, is tackling this space with multi-functional home and personal fragrance products that claim to address broader wellness concerns like: sleep, stress, mood, and energy. They organize their assortment by concern:

NEOM Wellbeing states their home and personal fragrance lines, developed using essential oils, are focused on ”[providing] wellbeing moments for all through 100% natural fragrances.”

Although NEOM primarily operates in the United Kingdom, they have recently expanded to over 300 Ulta Beauty stores here in the US, as they gear up to open the US market to more “natural” and “wellness” positioned fragrances.

“Fragrance as Self-Care” - Beyond the Glass Bottle

Although these aren’t fragrances, these are related signals that indicate how other personal care categories are being influenced by the broader trend toward multi-functionality in self-care products:

Touchland Acquisition — CPG titan Church & Dwight acquired Touchland back in May 2025 for over $700 million after the brand saw meteoric growth amid the COVID pandemic; rocketing to the position of #2 best-selling hand sanitizer in the US as of 2024 according to Circana.

Ultimately, Touchland’s approach to a sluggish category like hand sanitizer (pre-COVID) was predicated on a single question: “What if hand sanitizer smelled good? / was cute? / wasn’t terrible?”

Their playful array of scents like “Rosewater,” “Frosted Mint,” and “Citrus Grove” (which is my personal favorite) also include hand moisturizing benefits — a multi-functional combo that improves upon the otherwise “hospital-like” experience of virtually every other sanitizer.

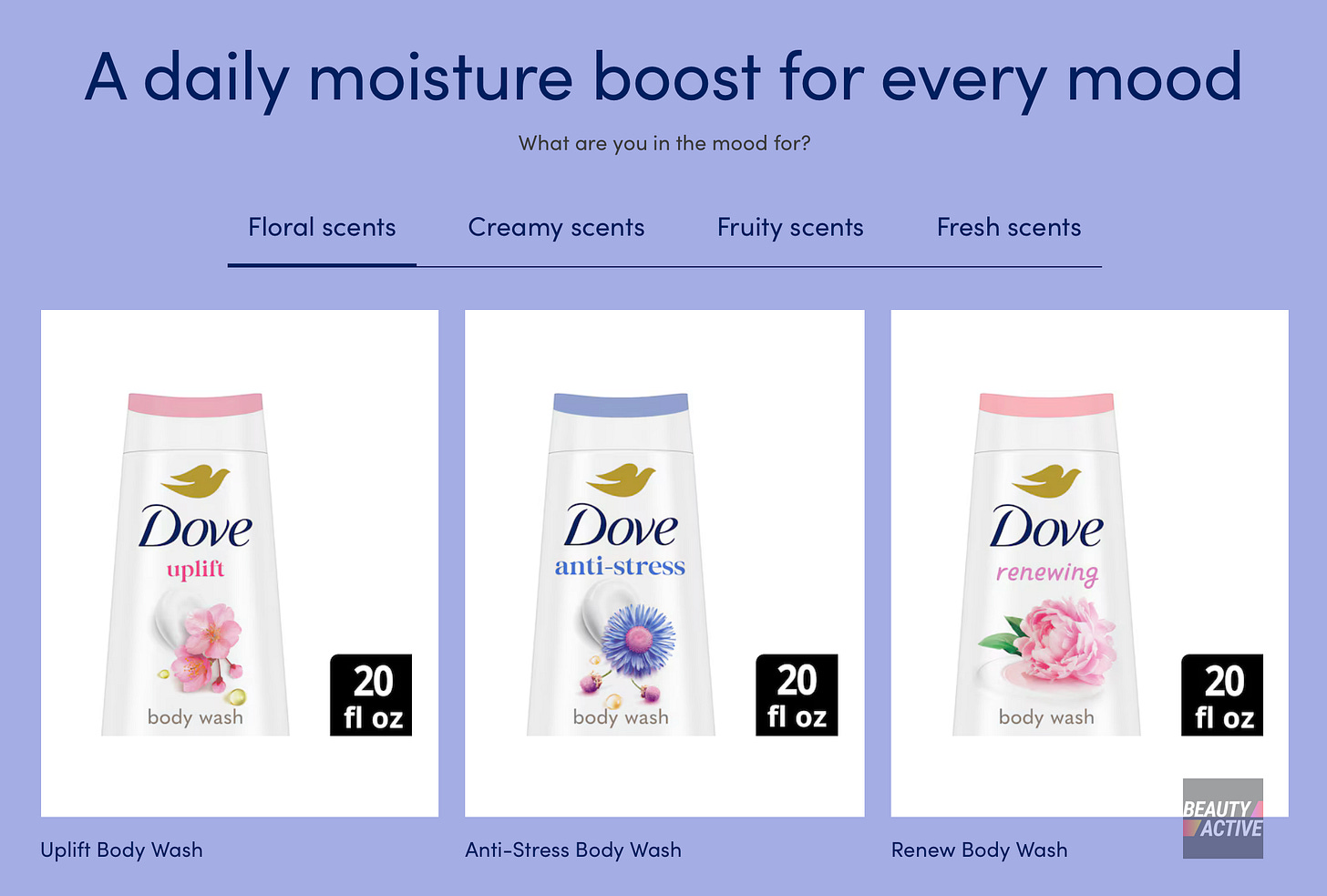

Dove Mood-Boosting Body Wash — Dove body washes have also gotten the mood-boosting treatment, with a new set of floral-scented washes utilizing ingredients like: lavender, chamomile, and rose to deliver new positioning surrounding each fragrance’s mood-elevating benefits as part of self-care.

Dove’s lineup of Mood-Boosting Body Washes featuring scent names like: uplifting, anti-stress, renewing, Dove Products Page (Linked)

Amid Inflation, Shoppers are Strategically Spending on their Favorite Scents

Versatility and cost effectiveness are becoming increasingly important within the beauty category amid tariffs and inflation. With limited dollars, shoppers are rethinking how they spend of nice-to-have categories like fragrance.

Rather than buying multiple single-purpose products, they are looking for ways to stretch their dollars without sacrificing experience. For fragrance, that means seeking out multi-use, layered, or alternative formats to more expensive EDPs.

One example: Instead of going for an unscented lotion and separate luxury perfume, shoppers may now be more likely to reacher a scented body lotion that is infused with their favorite fragrance — a two-in-one that feels indulgent but still practical. Meanwhile other shoppers might be trading down from expensive EDPs to lower cost body mists.

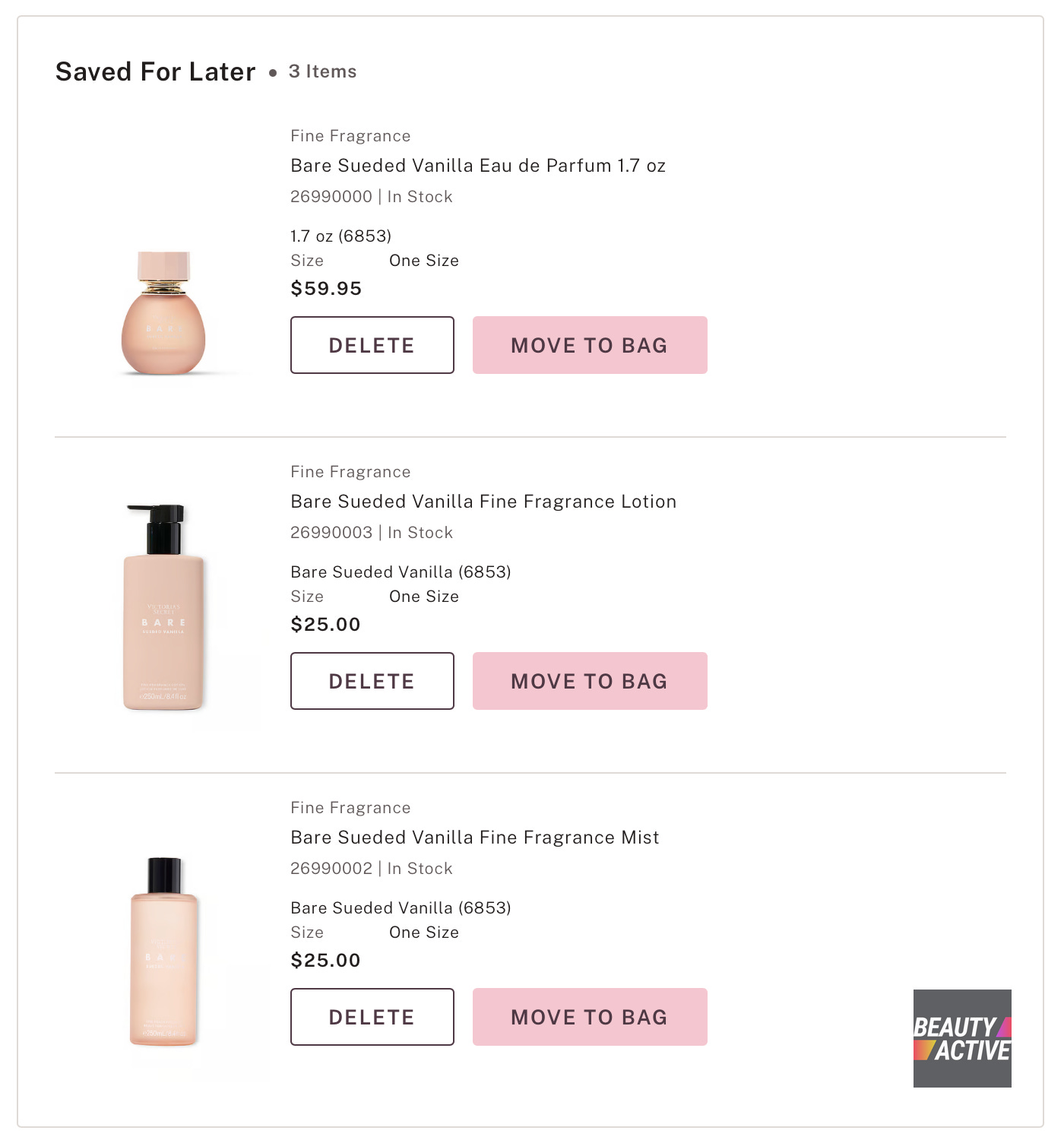

Popular scents from Victoria’s Secret illustrate this perfectly:

Bare Sueded Vanilla, Eau du Parfum 1.7fl oz. = $60

Bare Sueded Vanilla, Fragrance Lotion, 8.4 fl oz. = $25

Bare Sueded Vanilla, Fragrance Body Mist, 8.4 fl oz. = $25

Instead of spending $60 on just one EDP, shoppers can spend $50 and get both the fragrance lotion and body mist in the same Bare Sueded Vanilla scent; layering both to recreate the EDP experience while also gaining 16 ounces of product, $10 savings, not to mention the added moisturizing benefits of the lotion!

What’s more is that, according to research from Mintel, roughly 47% of body mist users believe they work as well as stronger EDPs and colognes. (via BeautyMatter) This perception, combined with tighter budgets, means a shopper might look at this mist-and-lotion pairing as a smarter, more versatile buy that satisfies both their sensory wants and economic needs.

The New Language of Functional Fragrance

Fragrance is quickly shifting from style accessory to lifestyle tool. From mood-boosting and wellness claims, to scented hybrids and body care extensions, the category is expanding beyond just indulgence and now into utility.

For beauty leaders, this shift demands a new kind of positioning: Functional fragrance isn’t just a claim but a mindset which blends both emotion and efficacy. Whether it’s through new formats, cross-category innovation, or value-driven basket building, shoppers are signaling that scent must now do more. A key question for brands to answer is not just “What does it smell like?” but now “What does it do for me?”

Active Signals

Other interesting updates from across the beauty landscape

Honeydew is a dermatology telehealth startup helping you access skincare solutions. Have you tried getting a derm appointment lately? Good luck!

Honeydew offers a digital subscription service that gives customers instant access to a dermatologist for care, including Rx-grade products and medications. Honeydew’s co-founder, David Futoran started it alongside his own dermatologist, Dr. Joel Spitz.

Before and After skincare results of Honeydew CEO / co-founder, David Futoran. Talk about dog-fooding!, Honeydew website (LINKED)